Take home pay calculator hourly rate

Double check your calculations for hourly employees or make sure your salaried employees get the right take home pay. Well show you the payroll taxes overtime rates and everything else you need to get those paychecks right this time.

Use Smartasset S Utah Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Retirement Calculator Property Tax Financial

Minnesota Paycheck Calculator Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

. Ad Read reviews on the premier Paycheck Tools in the industry. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. There are two options in case you have two different overtime rates.

For example for 5 hours a month at time and a half enter 5 15. 3 Ways To Calculate Your Hourly Rate Wikihow Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf. This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis.

How do I calculate hourly rate. As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day. A Hourly wage is the value.

First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. In the Weekly hours field enter the number of hours you do each week excluding any overtime. In the Weekly hours field enter the number of hours you do each week excluding any overtime.

This calculator is intended for use by US. These hours are equivalent to working an 8-hour day for a 4-day 5-day work week for 50 weeks per year. It can also be used to help fill steps 3 and 4 of a W-4 form.

Calculate your take home. Total yearly take-home salary Gross salary Total deductions 7 lakhs 48600 642400. If you need a little extra help running payroll our calculators are here to help.

Annual Take home pay 127025 254050 550442 6605300 Taxable income 161538 323077 700000 8400000 Superannuation 16962 33923 73500 882000 Total taxes. Holiday Pay Rate Add percentage based payrise. The salary calculator for 202223 India.

Hourly Paycheck and Payroll Calculator Need help calculating paychecks. For example if an employee has a salary of 50000 and works 40 hours per week the hourly rate is 500002080 40 x 52 2404. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the.

Next divide this number from the annual salary. Enter the number of hours and the rate at which you will get paid. GetApp has the Tools you need to stay ahead of the competition.

PAYE of Thresholds Tax Tiers. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

The calculation is based on the 2022 tax brackets and the new W-4 which in 2020 has had its first major. Yearly salary 52 weeks 37 hours per week. Choose Your Hours Tools from the Premier Resource for.

30 8 260 - 25 56400. If you know your tax code you can enter it or else leave it blank. Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above.

Hourly Wage Calculator This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. Method 1 Method 2 How much do you get paid. Get the latest resources via email.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees. To keep the calculations simple overtime rates are based on a normal week of 375 hours. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Related Take Home Pay Calculator Income Tax Calculator. Calculate your take home pay from hourly wage or salary. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

The adjusted annual salary can be calculated as. Ohio has a progressive income tax system with six tax brackets. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

Overview of Minnesota Taxes Minnesota has a progressive income tax system with rates that range from 535 to 985. New Zealands Best PAYE Calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Pay calculator Use this calculator to quickly estimate how much tax you will need to pay on your income. Next divide this number from the. Based on up to eight different hourly pay rates this calculator will show how much you can expect to take home after taxes and benefits are deducted.

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Calculate your take home pay KiwiSaver Student Loan Secondary Tax Tax Code.

Your average tax rate is. Take-Home-Paycheck Calculator Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary. 34513 69027 149558 1794700 Your salary breakdown Total 84000 Take home pay 661k Total taxes 179k.

Calculate your take home pay from hourly wage or salary. Budget 2022-23 This calculator has been updated to use 2022-23 Budget however figures may change in the October 22 Budget update. There is in depth information on how to estimate salary earnings per each period below the form.

It can also be used to help fill steps 3 and 4 of a W-4 form. Switch to salary Select Your State Where does your business operate. Overtime Pay Rate OTR Regular Hourly Pay Rate.

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. This calculator is intended for use by US. Hourly Calculator Federal Hourly Paycheck Calculator or Select a state Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

It can also be used to help fill steps 3 and 4 of a W-4 form. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Take home pay 656k.

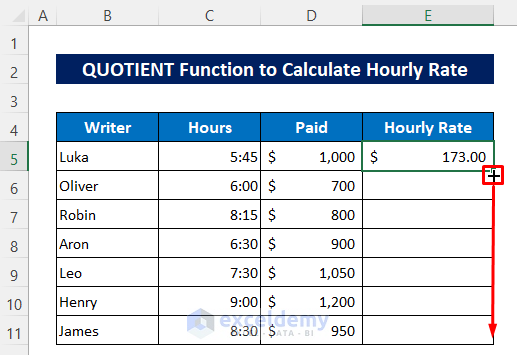

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy

3 Ways To Calculate Your Hourly Rate Wikihow

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into Accoun Paycheck Salary Oregon

Babysitting Rates Calculator Babysitting Activities Pay Calculator Babysitting

Hourly Rate Calculator The Filmmaker S Production Bible

Salary To Hourly Salary Converter Salary Hour Calculators

Hourly Paycheck Calculator Hourly Payroll Calculator Payroll Paycheck Calculator

Hourly To Salary What Is My Annual Income

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Paycheck Excel Good Essay

Paycheck Calculator Take Home Pay Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Formats Samples Examples

Hourly Paycheck Calculator Hourly Payroll Calculator Hourly Wage Calculator Payroll Paycheck Wage

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Formats Samples Examples

Hourly Rate Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Calculator

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Hourly Rate Calculator